Payment Solutions

Card Solutions for Individuals and Corporates

Comprehensive suite of card services tailored to meet the unique needs of both individuals and businesses.

Sep 18, 2024

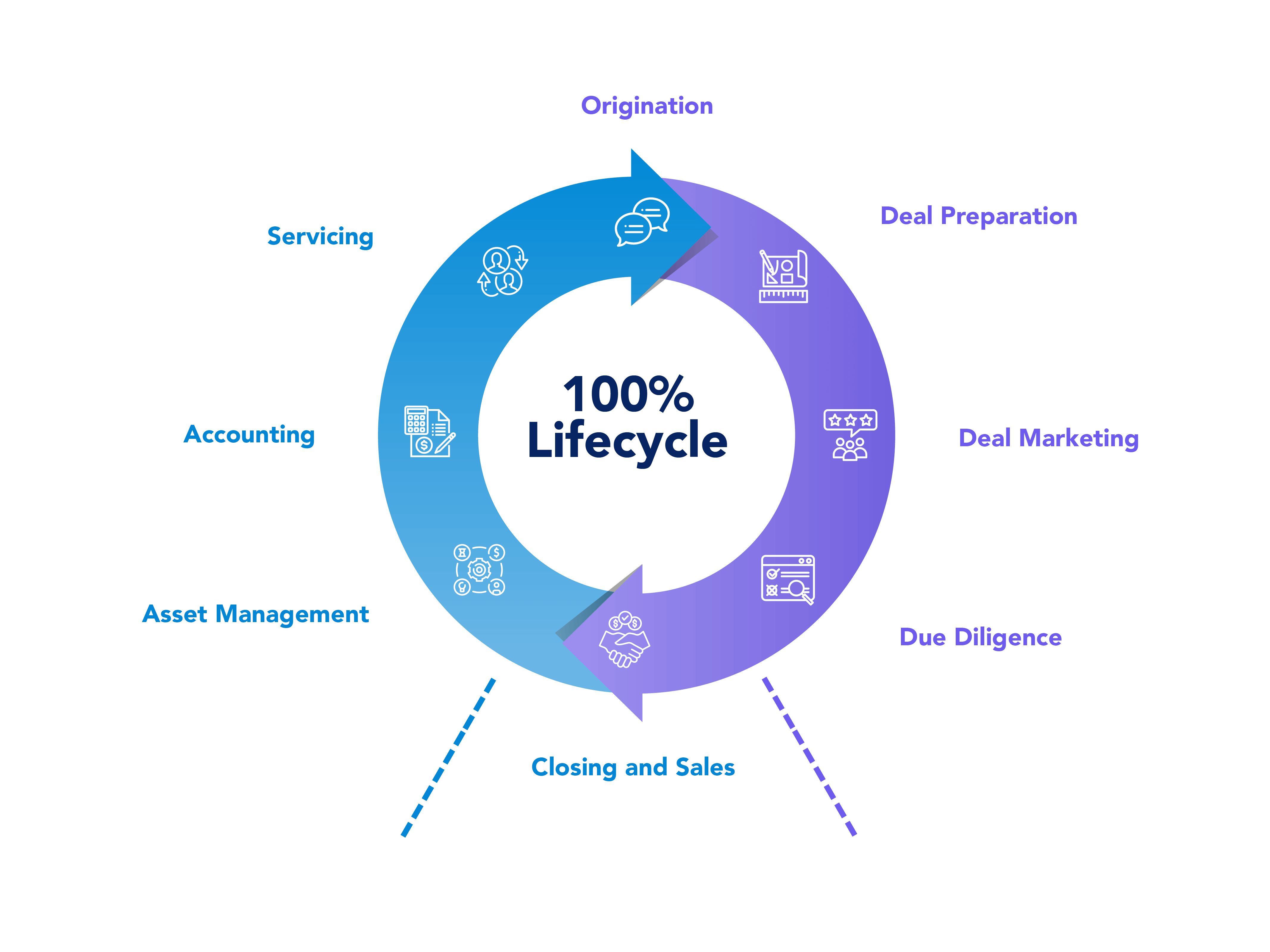

Unlock Comprehensive Card Solutions for Individuals and Corporations

In today's fast-paced digital economy, individuals and businesses demand seamless, secure, and flexible payment solutions. Whether managing everyday purchases with a debit card, accessing credit for significant expenses, or leveraging prepaid and benefits cards for specific needs, having the right card solutions is critical for financial efficiency and growth. At Synergy FS, we offer a comprehensive suite of card services tailored to meet the unique needs of both individuals and businesses. With various solutions, from debit and credit cards to specialized prepaid and benefits cards, we ensure you can manage your finances effortlessly, securely, and conveniently.

Debit Cards: Easy Access to Funds Anytime

Debit cards remain a popular choice for day-to-day transactions, offering real-time access to your funds without needing cash. Our debit cards give individuals easy access to checking accounts, enabling instant purchases and ATM withdrawals. For businesses, our business debit cards are perfect for managing expenses while maintaining control over corporate funds.

Key Benefits:

Instant access to your funds.

Secure transactions with chip-and-PIN technology.

Easy ATM withdrawals worldwide.

Expense management and tracking for corporate accounts.

Credit Cards: Flexible Credit with Added Perks

Credit cards are more than just a tool for managing finances—they're essential to building financial security and enjoying rewards for everyday spending. Our credit cards offer attractive rewards programs, cashback offers, and low interest rates, perfect for individuals looking to maximize their spending potential. For businesses, our corporate credit cards provide higher credit limits, detailed expense tracking, and travel-related perks that support the growing needs of your business.

Key Benefits:

Flexible credit limits and competitive interest rates.

Rewards programs, including cashback, travel points, and discounts.

Corporate cards with detailed expense reports for easier financial management.

Secured credit cards for those building or rebuilding their credit.

Prepaid Cards: Simplify Spending and Budgeting

Prepaid cards offer a convenient alternative to traditional banking, especially for those who want to control their spending or do not have a bank account. Our prepaid cards, including gift cards, payroll cards, and travel prepaid cards, can be used anywhere major credit or debit cards are accepted. Ideal for individuals who prefer budgeting without the risk of overspending, these cards are reloadable and offer flexibility for personal and corporate use.

Key Benefits:

No credit checks or bank accounts are required.

Ideal for budgeting, gifting, or specific travel expenses.

Safe and secure, with funds limited to the preloaded amount.

Travel prepaid cards with favourable exchange rates for international trips.

Benefits Cards: Maximizing Employee Benefits

Businesses can optimize their employee benefits program with specialized benefits cards. Whether healthcare-related spending through Healthcare Spending Cards (HSA/FSA) or meal benefits, these cards allow businesses to manage and distribute funds dedicated to specific employee benefits efficiently, ensuring compliance and convenience. They can be restricted to particular categories such as healthcare, food, or transportation, ensuring funds are used as intended.

Key Benefits:

Customizable benefits categories for healthcare, meals, or other perks.

Preloaded by the employer, offering tax benefits and simplified administration.

Seamless tracking and reporting for both employees and employers.

Compliance with corporate benefits and tax regulations.

Specialized Corporate Cards: Streamlined Business Expenses

Businesses of all sizes need card solutions that cater to specialized needs, such as fleet management or travel. Our fleet cards allow businesses to monitor and control fuel and maintenance expenses for company vehicles, providing detailed reports on usage and enabling cost-saving measures. Corporate travel cards help manage expenses during business trips, offering cashback or rewards for hotels, flights, and meals, making it easier for businesses to streamline their travel operations.

Key Benefits:

Fleet cards are explicitly designed for vehicle-related expenses and have detailed tracking.

Corporate travel cards offer rewards and discounts for business travel.

Easy integration with corporate accounting systems for expense tracking.

Virtual and Digital Cards: Secure Online Transactions

In today's digital age, security is paramount. Our virtual credit cards offer a digital-only solution for online transactions, protecting against fraud and unauthorized use. These cards generate a unique card number for each transaction, making them perfect for e-commerce and subscription services. Businesses can issue virtual cards to employees for online purchases, reducing the risk of fraud while maintaining control over expenditures.

Key Benefits:

Enhanced security for online transactions.

One-time use numbers prevent unauthorized charges.

Immediate issuance and no physical card are required.

Easily integrated with mobile wallets and apps.

Payroll Cards: Modernize Employee Payments

For businesses looking to simplify payroll, our payroll cards offer a convenient way to pay employees without requiring a traditional bank account. This is especially useful for companies with a sizeable unbanked workforce or those in industries where cash payments are expected. Employees can use payroll cards to access their wages immediately, make purchases, or withdraw cash, making payday smoother and more efficient.

Key Benefits:

Convenient, safe, and efficient wage distribution.

There is no need for employees to have a traditional bank account.

Reloadable cards ensure continued use without additional paperwork.

Accessible funds via ATMs or point-of-sale systems.

The Synergy FS Advantage

At Synergy FS, we are committed to providing the most comprehensive range of card solutions available. Whether you are an individual looking for flexibility and security in your finances or a corporation seeking optimized solutions for expense management, our cards deliver the control, security, and value you need.

Custom Solutions: Tailored card programs that suit your personal or corporate needs.

Advanced Security: Cutting-edge security features, including fraud protection and encryption.

Rewards and Perks: Access to reward programs, cashback, and premium benefits.

Global Acceptance: Cards that can be used worldwide, giving you flexibility wherever you go.

Dedicated Support: Our customer service and account management teams are here to ensure your card solutions work for you.

Conclusion

From everyday debit cards to specialized corporate solutions and prepaid cards for various needs, Synergy FS offers a complete suite of card products that enhance financial management for individuals and businesses. With the flexibility to meet diverse financial goals and robust security measures, we empower you to take control of your financial future, streamline business expenses, and provide exceptional value through our advanced card solutions.